Is it better to pay cash to purchase an automobile or is it better to take out a loan? This guy would say to never, ever, ever take out a car loan…

…but does it really make a difference? Let’s do the numbers. When you do a mathematical calculation or experiment, all the factors have to be exactly the same, i.e. the amount that you pay for the car, the interest rate, the net interest rate that you might get on your money, or that you would be charged for a loan, and the period of time.

According to my Google search below, the average cost of a new car is around $50,000.

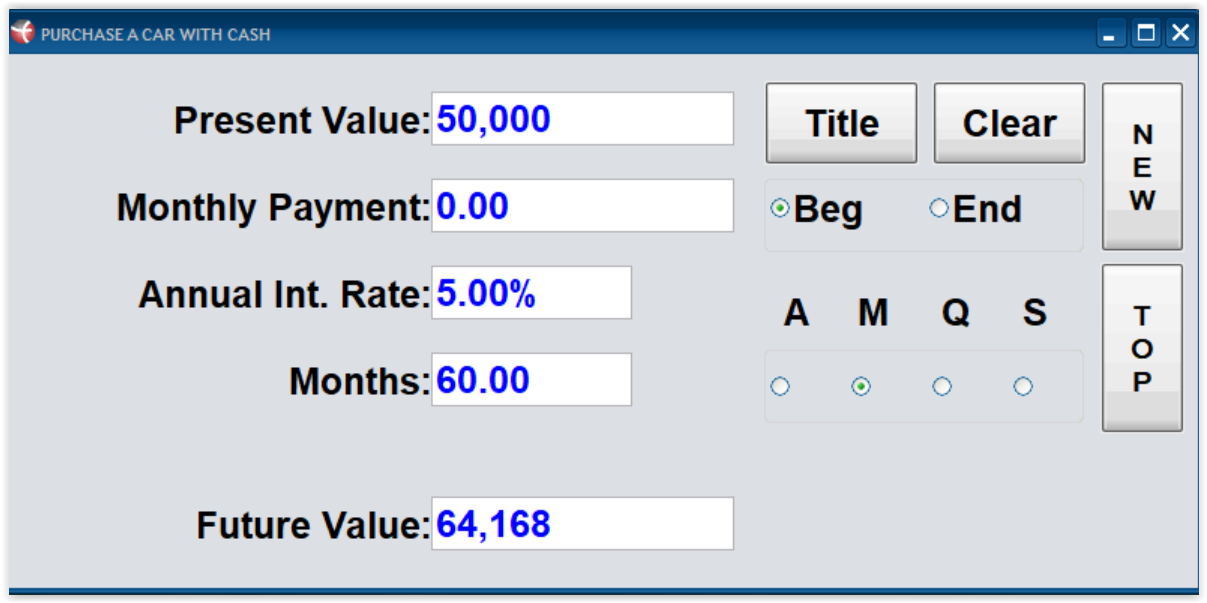

I’m going to put into my calculator (below) a present value of $50,000 for the pretend car I’m buying. If I’m paying with cash, I don’t have a monthly payment ($0.00). We’ll compare our calculations over the same period of time, which is 60 months or 5 years. I am using the same interest rate for each of the calculations. We’re just going to pretend we have $50,000, not making any payments, and getting a 5% net rate of return over 60 months. So, that $50,000 that I spent on a car would have grown over 5 years to be $64,168. Again, I purchased an automobile with cash for $50,000, but if I had kept that $50,000, I might have earned interest and possibly had $64,168 after 5 years.

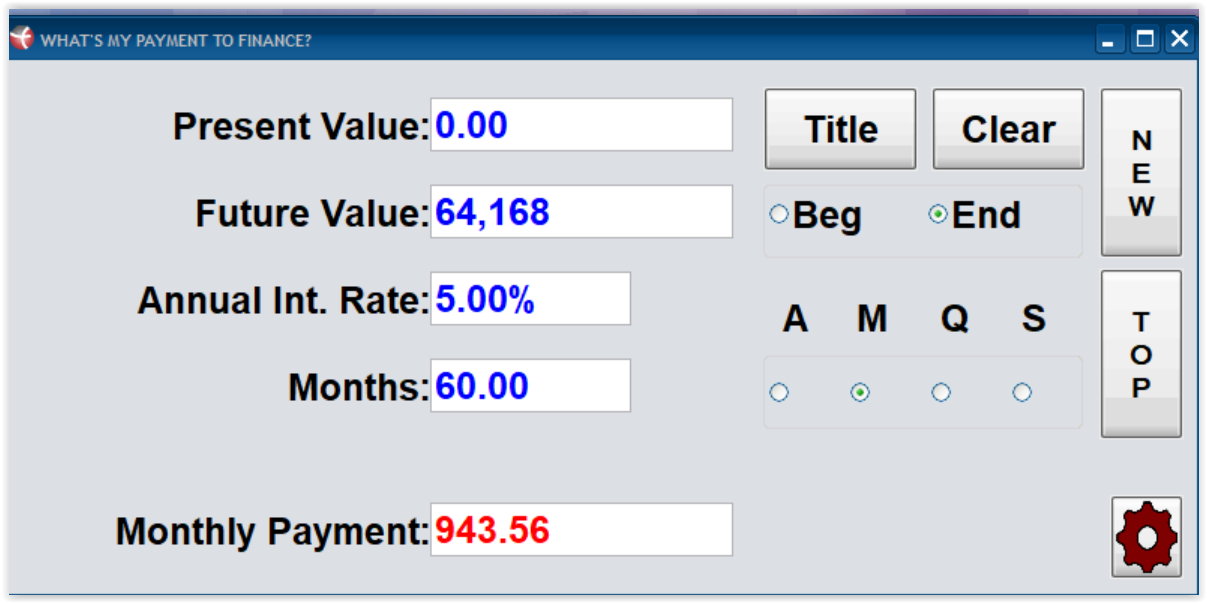

Now we’re going to calculate what our monthly payment would have been to the finance company or credit union if we had taken a loan instead. Here’s how we do that: I’m going to take the future value from the previous calculation and make it the future value ($64,168) in the new calculation below. We keep everything else the same. If this was a loan, there is no money to begin with and the present value is $0.00. I need to pay someone else what will equal $64,168 in the future. I am basing that on the same 5% interest rate. I am doing this over the same period (60 months). This tells me the amount of money I would have to put in every month to pay someone $64,168 and my monthly payment would be $943.56.

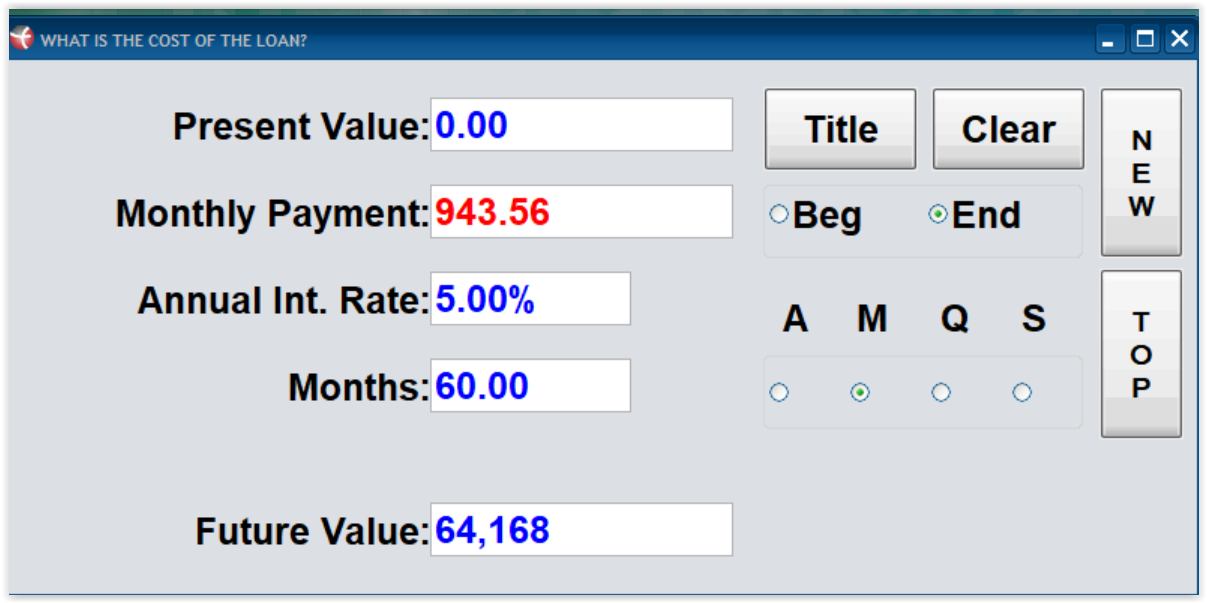

Now, I’m going to copy that monthly payment ($943.56) and triple-check my numbers. So now I’ve got to look at the cost of the loan. I’m going to make a payment every month of $943.56. I’m going to use the same 5% interest rate. It’s over the same 60-month period of time, and we get our future value of $64,168. This is how I know this math is correct.

So, in my first calculation, had I kept my $50,000 with 5% interest for 60 months, I could have accumulated $64,168. In my second calculation, I determined what I would need to pay monthly to get $64,168 with a 5% interest rate for 60 months. Then I triple-checked the numbers. I took that $943.58 at 5% interest for 60 months and the cost for that car would have been $64,168. Everything else is exactly the same.

Here’s a potential problem. If I need money in the future for an emergency or another opportunity, but I paid cash for the car, I no longer have that money available. Now, my money is in my car. Here’s what you need to remember: either you pay interest to someone else (through the use of a car loan in this case) or you pass up earning interest. In other words, you never got that interest because you put all of that money into purchasing a car.

Here's another thought for you: what is the true cost of car ownership over your lifetime? Let’s say the person purchasing a car is 30 years old and let’s pretend their mortality age or age of death is 80. We need to take 80 years – 35 years to get their remaining lifespan. Remember, we’ve already calculated the first 5 years in the calculators above from age 30 to 35. That would mean they have 45 years left. I’m also going to make an assumption that this is the only vehicle that they purchase their entire lifetime. You and I know that’s not realistic, but I don’t want to depress you too much with the cost of multiple vehicles.

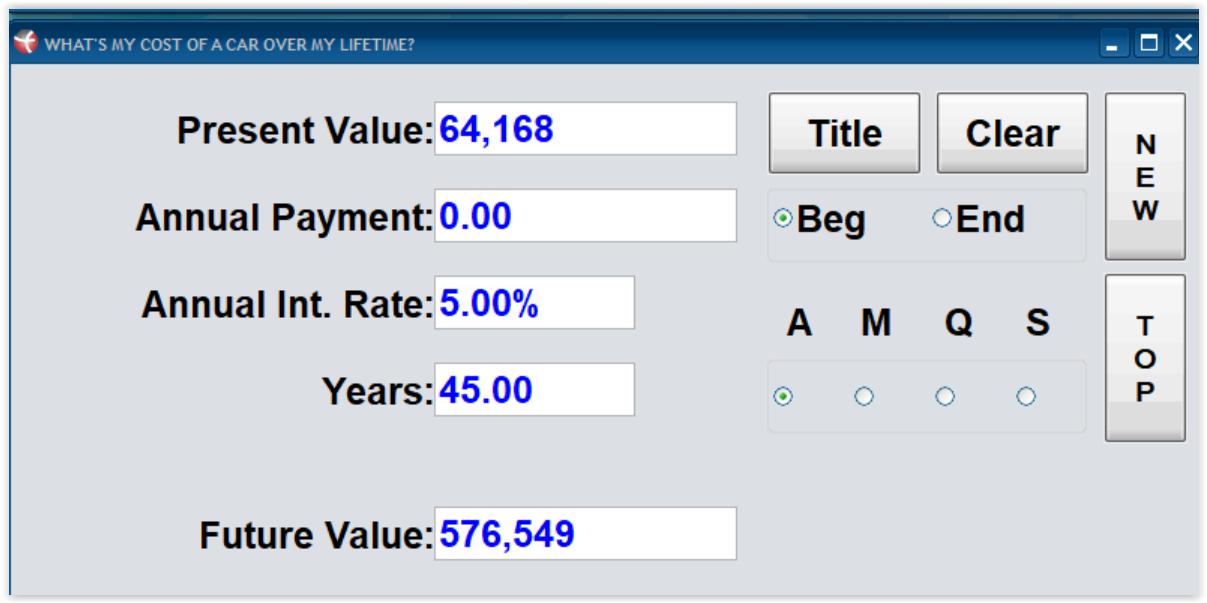

So, let’s take that future value from our calculations above of $64,168 and that will be the present value in our calculator below titled, “What’s my cost of a car over my lifetime?” I don’t need to make any more annual payments ($0.00) because this is the only car for the rest of my life. So, at this point, it didn’t make a difference whether I financed it or paid for it with cash. I already know I’m out $64,168. Let’s pretend my interest rate continues to be 5%. This is now over a period of the next 45 years of my life until I reach age 80. My future value, whether I initially took it out in the form of a loan or whether I paid it in cash, not including gas and oil and insurance, just the cost of one automobile over my lifetime is possibly $576,549 out of my economy.

It’s important to look at your own situation when you are questioning if it’s better to pay cash or take out a loan. We have to look at: what is the cost of money? What is the lost opportunity cost of that money? What is the term or period of time? In the calculator above, we were able to show you projected future value over your entire lifetime. So, what is the best thing to do, pay cash or take a loan? The best answer: It depends.

If you have questions regarding your own, specific situation and would like us to run the numbers with you to determine the best course of action, then perhaps it’s time to schedule your Financialoscopy®.