When you insure your home, your agent calculates its replacement cost. When you insure your car, the insurance company looks at blue book values. Then why is it most people simply guess when it comes time to insuring their life?

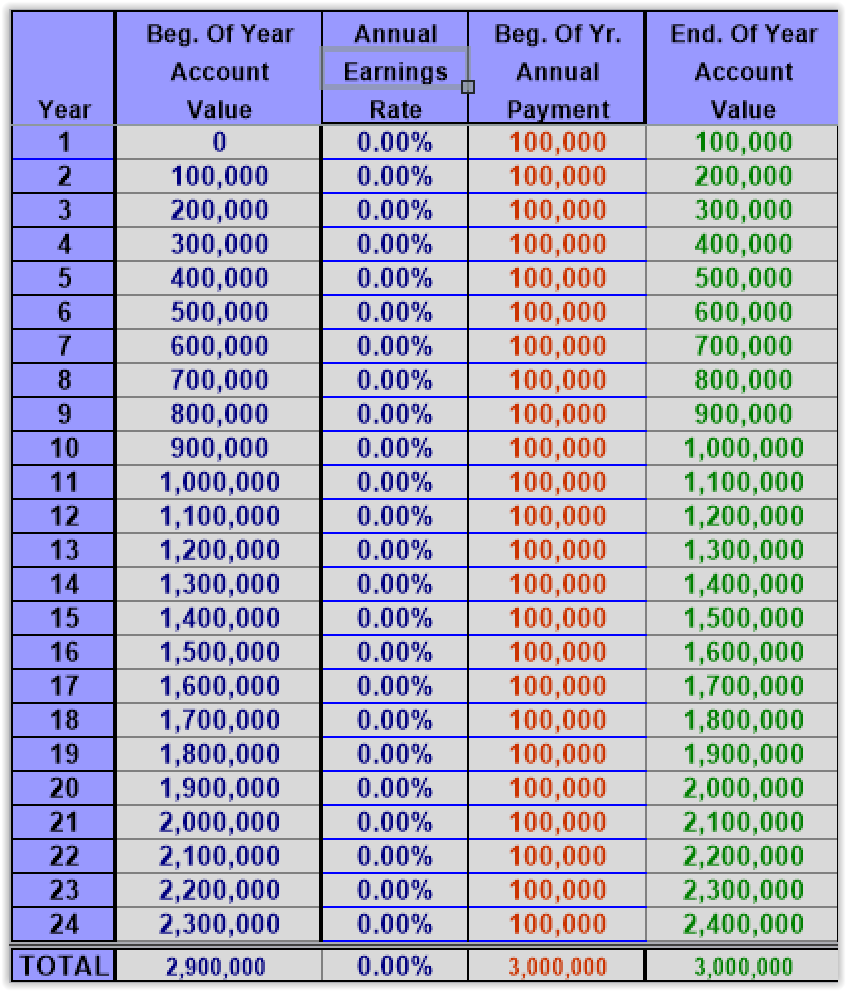

Let’s do some quick math. Let’s say that you’re 35 years of age. You currently earn $100,000 per year. You would want to measure that value over the next 30 working-years of your life, to the retirement age of 65.

Over those 30 years, $3,000,000 would have flowed through your fingers. You might not feel like a millionaire; but actually, you’re a t$3 millionaire! This example, unfortunately, has a huge error embedded into it. It assumes that you never received a raise – never ever, for the rest of your life. Over this past year we’ve seen wages increasing due to the effects of inflation. For our calculations, let’s assume you receive a modest 3% annual pay increase.

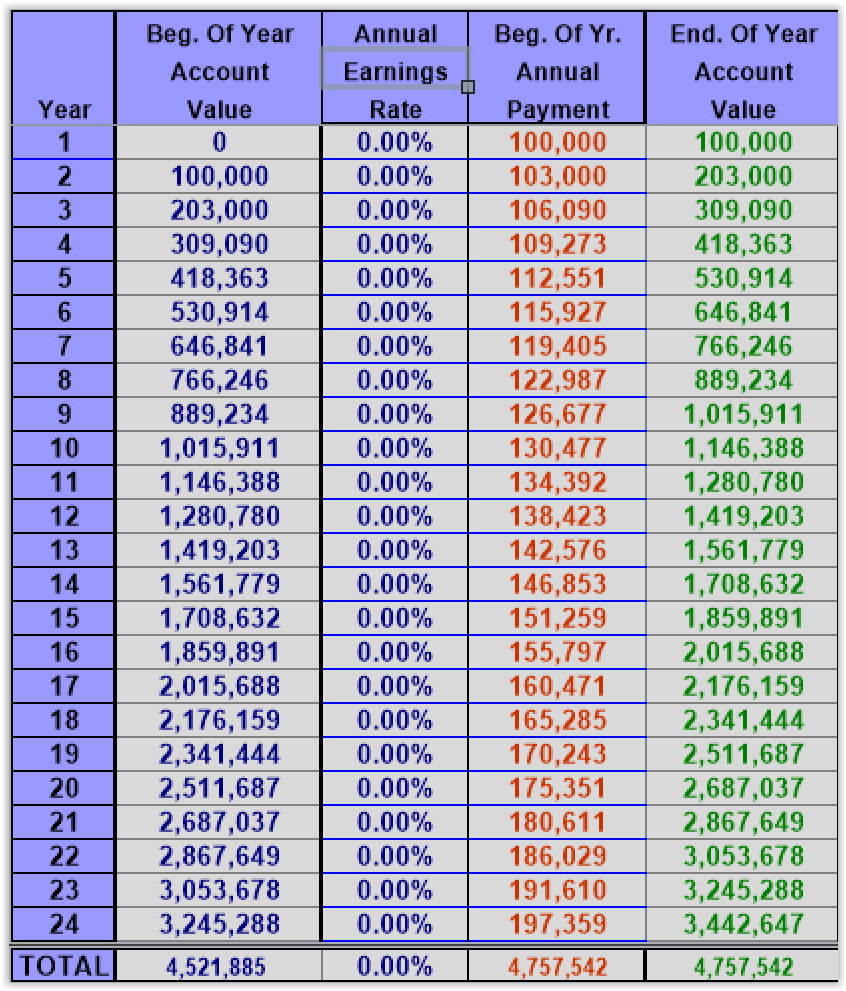

As you can see from year one to year two, your income went from $100,000 to $103,000; or 3%. If that calculation were to continue during your working lifetime, $3 million doesn’t pass through your fingers, but a total of $4.7 million dollars. Just like the replacement value for your home increases with time, so it most often is with your human life replacement value.

Here's the problem. This calculation doesn’t include any of your employee benefits, such as your employer’s 401(k) match. That stops at death, as does the employer-paid health insurance you had, while you were alive. Had those dollars been counted, your value would greatly exceed $5,00,000.

Wouldn’t you want to insure all it, everything that would have ended with the ending of your life? Isn’t this what your true human life economic value is? Surprisingly I still see people accepting someone’s rule of thumb of five or ten times their annual income as the supposedly correct amount. That’s like insuring a couple of rooms of your house. If a tornado comes through, you don’t really need all of your house, do you? (I’m being sarcastic here) Of course, you would want to insure it all. That’s what insurance is supposed to do.

Here's the good news, if these numbers scare you. The insurance company won’t allow you (based on this example) to purchase this amount of life insurance; but what they will allow you to do, is to purchase an amount of insurance that can be deposited into an account income tax-free, that can generate your future annual income for your family for the next thirty years securely and safely, using conservative, predictable returns without putting your loved ones at risk of a failed life, twice. First, your death. Second, not properly planning for your death. Insure your life, as you would your car or your home, for its full replacement value.